The power of the World Wide Web has been leveraged to reach out to millions across the globe. Health 2.0 is the latest health tool which uses the power of social media to unite healthcare professionals and patients, delivering improved healthcare and education at the click of a button

The power of the World Wide Web has been leveraged to reach out to millions across the globe. Health 2.0 is the latest health tool which uses the power of social media to unite healthcare professionals and patients, delivering improved healthcare and education at the click of a buttonWith the growth of online technology and mobile innovations, health information has never been more accessible. Given the constraints of working in a tightly regulated environment, life sciences companies (pharma, biotech and medical device) have hesitantly adopted Health 2.0, treating it as a minor component of their commercial strategies and marketing plans.

In contrast, patients, physicians and other key healthcare players have readily adopted Health 2.0. This decreases the level of control that life sciences companies have over the way their customers obtain product information and marketing messages. Despite the potential risk associated, these companies need to ask themselves, “Can we afford to ignore Health 2.0?”.

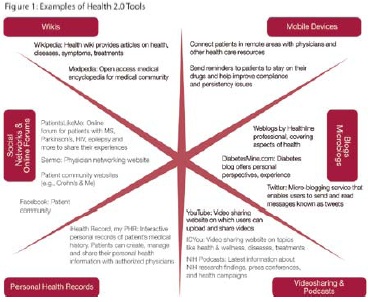

Definition of Health 2.0: Web 2.0-based online networks and mobile-enabled services where patients, health professionals, biomedical researchers, life sciences companies, payers and government can interact globally (see Figure 1).

Capgemini Consulting recommends that the life sciences industry embrace Health 2.0 as a way to gain valuable market insights and heighten engagement with their customers. The evolution is occurring now—it’s time to play or be played.

The Rise of Health 2.0

The Rise of Health 2.0Adoption of Health 2.0 by patients and physicians has continued to grow significantly across all age groups. The number of users looking for online information regarding prescription drugs grew from 25 million in 2002 to 100 million in 2008. The Internet is now the top source of health information for adults in the U.S., outranking their own physicians.1 Despite that growth, life science companies spent less than 3 percent of their total ad expenditure for prescription medications on Internet ads in 2008 ($130 million) according to TNS Media Intelligence.

Behind search engines and health portals, social media is the third main online tool used by adults in the U.S. to find health information.3 Wikipedia, for example, is one common, well-known social media source. A confluence of factors has facilitated this shift, particularly the increased expectations in consumers’ minds of accessibility and active participation in social communities. This shift will have greater importance as the pharmaceutical industry transitions from blockbuster to specialty drugs, where marketing budgets are under pressure to reach a smaller target population, and in-depth knowledge of the niche market is critical.

There are several key factors that continue to drive the adoption of Health 2.0 practices:

– Mainstream Internet adoption

– Increased use of mobile devices

• Favorable market forces

– Transition from blockbuster to specialty drugs

– Government acceleration of electronic health records

• Change in patient and physician behaviors

– Increased active engagement and control of personal health

– Access to online community and social networks

Healthcare Stakeholders Already Embrace Health 2.0

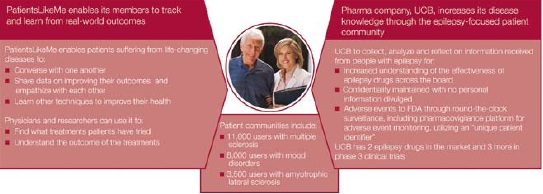

Where life sciences companies have been slow to adopt Health 2.0 practices, several healthcare stakeholders have leveraged online tools and communities with impressive results. In this healthcare perspective, the key healthcare stakeholder groups are patients, healthcare providers, payers, the government and researchers.

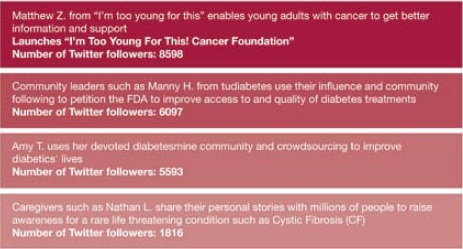

While the influence of Key Opinion Leaders (KOLs) remains important among the physician community, Patient Opinion Leaders (POLs)—specific individuals sharing their personal experiences via a Patient Support Network independent of geography—are wielding significant influence among patients of specific diseases. POLs use social media like YouTube, Facebook and Twitter, providing their followers information about specific diseases from a patient point of view (see Figure 2). Respected by their fellow patients, they often provide coaching, assistance and best practices while navigating the healthcare system and could be key partners in kickstarting a Health 2.0 strategy. The Kru report shows that POLs with unbranded websites have a greater number of followers when compared to branded websites.

Physicians Embrace Health 2.0 with Patients and Peers

Physicians are embracing social media primarily to access real-time data and gain peer support on patient care. Studies show that 78 percent of physicians in the U.S. use digital media to gather information on medicine and 18 percent use the Internet during patient consultation.5 Through online communities like Sermo and MedScape, healthcare professionals can generate real-time discussions and share information across geographies and medical specialties.

Payers Leverage Health 2.0 to Improve Revenue and Contain Costs

Payers view Health 2.0 as an opportunity to improve revenue generation by offering better products and services to their customers and to contain costs by managing care and reimbursement more efficiently (see Figure 3).

Health 2.0: A World of Opportunities for Life Sciences Companies

Health 2.0 has the ability to:

• Drive new market insights

• Improve disease management

• Penetrate new markets

The Impact of Health 2.0 on the Product Life Cycle

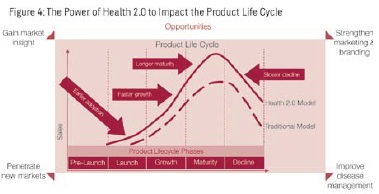

Integration of Health 2.0 can improve overall sales across the product life cycle (see Figure 4). Using social media to shorten the R&D cycle by driving market insights can help bring products to the market sooner and with better functionality. Social media increases awareness which compresses the adoption curve. With improved disease management using Health 2.0 tools, patients remain compliant longer, resulting in longer maturity and slower decline phases.

Health 2.0 can increase the adoption rate and extend the product life cycle of new drugs, which is important for the success of these drugs, especially for niche drugs or chronic diseases. In Capgemini Consulting’s opinion, social media has the potential to generate a significant positive impact across the product life cycle.

Case in Point: Physician Benefits

The American Heart Association (AHA) and American College of Cardiology (ACC)’s Pinnacle registry helps cardiology practices provide physicians guidance on managing their patients’ risk factors. Using data from its computerized medical record system to measure performance across targets (e.g., patient cholesterol levels), physicians within a specific practice were able to help their patients hit their goals, shifting from 70 percent to 90 percent compliance.

Gaining Market Insight

• Increasing understanding of therapeutic areas

• Improving product launch preparation

• Accelerating uptake at launch

• Improving post-launch management

The current regulatory environment lays greater emphasis on risk management, from initial drug approval to Risk Evaluation and Mitigation Strategies (REMS). Health 2.0 tools—online, mobile or both—can help with compliance and persistency, through the increased access and frequency of communications with patients and the integration of patient health records.

Life sciences companies can use Health 2.0 as a key component of their outreach. Health 2.0 provides an opportunity to address compliance and persistency issues, bringing together key stakeholders faster and at a lower cost, and tracking positive outcomes for drugs using real-world data. Social media tools can improve patient health monitoring by increasing patient involvement, as compared to limited monitoring through routine physician visits. While the end result is improved patient health, the benefits to improved disease management extend to physicians and payers.

Examples of Health 2.0 tools to improve disease management include:

Examples of Health 2.0 tools to improve disease management include:• Diagnostic tools (e.g., iPhone apps)

• Support communities (social networks)

• E-consultations (remote health diagnoses)

• Online health stats monitoring (statistical health tracking)

• Health reminders (notifications to help patient compliance)

• Real-world outcomes research (shared treatment and symptom information via Patient Support Networks)

• For instance, diabetes patients use iPhone apps like Glucose Buddy and WaveSense Diabetes Manager that allow patients to log, review, and share their blood glucose data with their physicians.

Penetrating New Markets Niche Target Populations

As life sciences companies shift their development towards products for niche markets, Health 2.0 can help them align those drugs to the smaller target populations. Social media can increase access and shorten the time to reach their targets, through more directed marketing communication to physicians, patients and payers. Shifting customer practices are also leading to other potential opportunities:

• Outcome-based pricing and changes in formulary approval processes demonstrate the need for life sciences companies to provide additional scientific evidence and health outcomes data.

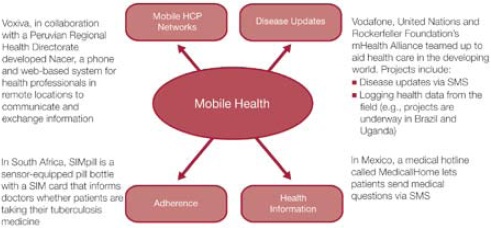

Developing countries offer new markets for life sciences companies, and the strong mobile penetration in these countries can be leveraged to access patients and accelerate sales. SMS-based (text) technologies can improve reach and can help to increase patient compliance with medications. In addition to SMS, Health

2.0 tools offer lower-cost methods of communication that can be delivered to smaller target populations (see Figure 6 .8)

According to Terry Kramer, strategy director at British operator Vodafone, “There are 2.2 billion mobile phones in the developing world, 305 million computers but only 11 million hospital beds.”9 Through the use of mobile technologies, life sciences companies can provide value-added healthcare services and increase their customer base.

Strengthening Brand Equity

Patients and physicians are demanding greater transparency, and life sciences companies can provide that while also improving their brand image through social media. KOLs and POLs have broader audiences online than ever before. Establishing two-way

communications with these opinion leaders and a company’s target population enhances the company’s credibility. Health 2.0 also offers the opportunity to build awareness through viral marketing campaigns. In a survey by ORC Guideline looking at 2012 marketing plans, U.S. pharmaceutical marketers weighted websites and emerging media as more important than traditional marketing channels.

Capgemini Consulting recommends life sciences companies establish POL relationships to help broaden the reach of their message and increase their proportion of a consumer’s “share of mind.” This type of relationship for life sciences companies is a challenge that must be internally managed, given the risk associated with and resistance to the potential loss of control of the marketing message.

Life sciences companies are now accepted as part of physician online communities, with 59% of physicians welcoming pharma participation on physician social networks.11 With an average physician age of 47, Sermo allows visitors to poll the community and post questions and also features icons located next to targeted conversations to facilitate access to relevant pharma information and services.

Health 2.0 is not without risks, which has limited the adoption of these tools by life sciences companies, especially in a risk-adverse and uncertain healthcare environment.

• Loss of control over messaging

• Regulatory and compliance concerns

• Measuring ROI

• Effective execution

Life sciences companies need to holistically weigh the benefits against the risks, as the opportunities can be substantial when looking at the overall potential return across the product lifecycle.

Loss of Control over the Marketing Message

Social media requires collaboration and transparency, leading to a natural loss of control over the message. As messages get re-communicated, they can get distorted. Traditionally, life sciences companies provide complete product information and education in static forms: marketing collateral and company-controlled product information websites. Marketing campaigns using viral or social media should be designed to enable patient or physician engagement while preventing dilution or distortion.

Increased Uncertainty Surrounding Regulatory Restrictions and Adverse Event Reporting

Tight monitoring is required and fast responses are needed if marketing messages are modified or misrepresented when forwarded. As social media evolves, tools like Google Sidewiki can enable unauthorized comments “alongside” a company’s own web pages, which can be monitored but not controlled, heightening the need for ongoing stakeholder interaction.

Online media and the mobile environment make it difficult for life sciences companies to fully disclose all risks and benefits. In 2009, controlled media, like display search engine ads, resulted in six life sciences companies receiving fines by the FDA due to the lack of risk information; responsibility for information that is not controlled by those companies is even more difficult to contain. Social media, like Twitter with its limit on characters, also restricts the feasibility of including risk information. POLs and KOLs do not have vested interests in providing balanced information. With this in mind, the challenge facing life sciences companies is how they can enable these types of communication while complying with FDA rules for providing full disclosure.

FDA hearings on social media on November 11-12, 2009 highlighted life sciences companies’ interest in receiving clarity on this topic, especially given the concern about potential increased adverse event reporting and the anonymity of the web. FDA guidelines for social media have not been released, but the FDA recognized the need to address several issues:

- Clarity is needed on how life sciences companies should handle adverse event reporting while complying with FDA rules.

- Techniques were suggested on ways to collect the information directly and simplify the process, including the usage of consumer-friendly language.

- The ability to recognize and capture the required information for an adverse event remains a challenge.

- Rules and guidelines are needed with regard to how liable life sciences companies are when they listen to their customers.

- Life sciences companies expressed interest in monitoring their customers for trends while containing exposure to increased risks.Companies should design their commercial strategies to incorporate adverse event reporting as an integral part of their social media campaigns.

What Is the ROI for Increased Customer Engagement?

What Is the ROI for Increased Customer Engagement?

Measuring ROI for social media, even outside of life sciences, remains difficult. For life sciences companies, where customers are often not able to buy their products directly, this added layer prevents direct tracking. ROI can be partially quantified through increased product and brand awareness but should not be the main goal for social media. The greater benefit is increased market insight, driving a positive effect on the product lifecycle, and deeper personalized relationships for increased customer engagement.

Despite the difficulty in measuring ROI, social media offers a strong cost benefit compared to other forms, due to its low infrastructural cost for tool development and maintenance, especially for developing countries or smaller niche markets.

Failure to Execute Social Media Well Life sciences companies have often failed to implement Health 2.0 well, treating it as a traditional one-way communication method. In response, patients and physicians ignore those companies’ efforts, resulting in low engagement.

A Partner to Successfully Help You Integrate Health 2.0 into Your Commercial Strategies

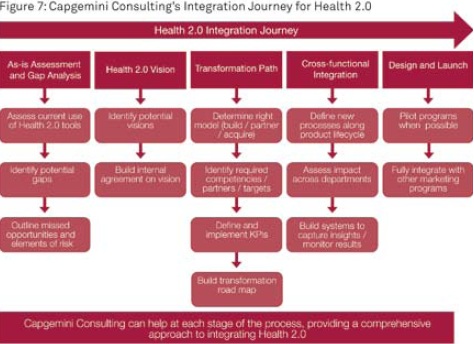

Capgemini Consulting has the experience to assist life sciences companies with designing and implementing Health 2.0 strategies (see Figure 7). Short-term opportunities include outreach to KOLs and POLs via social media, creation of a Health 2.0 company vision, or development of mobile applications for increased compliance or outreach in developing countries. A long-term strategy would integrate social media throughout the organization, from R&D to commercialization. With our experience in accelerating transformation, Capgemini Consulting can help life sciences leverage Health 2.0 as an essential element of its overall commercial strategies and marketing plans.

References

“How America Searches: Health and Wellness,” iCrossing, January 2008.

“Drug Makers to Press for Guidance on Web Marketing,” Wall Street Journal, November 12, 2009, p B4.

Source: Twitter. Retrieved on July 6, 2011.

“The Pharma-Twitter Experiment: How Brands Can Achieve a 14% Response Rate,” The Kru Report: e-Patient Connections, July 2009.

“Physicians’ Perspective: Digital Tools and the Pharmaceutical Sales Representative,” Sermo survey results, collected June 2011.

“Physicans in 2012: The Outlook for On Demand, Mobile, and Social Digital Media,” Manhattan Research, 2009.

“Battle with Heart Disease Moves to the Doctor’s Office,” Wall Street Journal, November 10, 2009, p. D4.

“UCB and PatientsLikeMe Partner to Give People With Epilepsy a Voice in Advancing Research” June 15, 2009, http://www.patientslikeme.com/press/20090615/18-ucb-and-patientslikeme-partner-to-give-people-with-epilepsy-a-voice in-advancing-research ;

Retrieved March 20, 2010 from http://mobilewellbeing.info

“Mobile Phones to Serve as Doctors in Developing Countries.” ReadWriteWeb. S. Perez. February 20, 2009. Retrieved March 3,2010 from http://www.readwriteweb.com/archives/mobile_phones_to_serve_as_doctors_in_developing_countries.php

“The “E-Dimensions” of Pharmaceutical Advertising,” ORC Guideline, Trend Report June 2009.

“Physician Online Communities: Physician Social Networking and the New Online Opinion Leaders,” Manhattan Research, Taking the Pulse v8.0 Study, 2008.

“Sermo Survey of US Physicians Indicates AMA No Longer Represents Them,” Sermo Press Release, July 8, 2009.

Retrieved March 20, 2010 from http://www.fda.gov/AboutFDA/CentersOffices/CDER/ucm184250.htm