UK Life Sciences Sector Plan Sets Sights on Global Top 3 by 2035

The UK Government has laid out a bold ambition: to become Europe’s leading life sciences economy by 2030, and the third-largest globally by 2035, behind only the United States and China. This is not a vague aspiration—it’s the central benchmark driving a detailed and accountable strategy, laid out in the Life Sciences Sector Plan (July 2025). The plan spans public investment, regulatory reform, NHS transformation, and regional infrastructure development—all with the goal of turning the UK into a powerhouse of biomedical innovation, health outcomes, and industrial growth.

Why Ranking Among the Top 3 Matters

Economic Significance

The UK life sciences sector already contributes over £108 billion in turnover and supports more than 300,000 jobs, but its growth potential is far from capped. Government modelling indicates that if current bottlenecks are addressed, the sector could grow by an additional £41 billion (165%) by 2035.

Climbing to the No. 3 global position would not only solidify the UK’s status as a top destination for research and development (R&D), but also spur exports, attract foreign direct investment (FDI), and generate high-value employment across the country.

Health and Societal Outcomes

Translating cutting-edge science into real-world clinical benefit is central to the plan. Accelerating the adoption of medical innovations will enhance patient access to new treatments and technologies, improve public health, and reduce economic losses. The UK currently loses £132 billion annually due to ill health among the working-age population—better, faster healthcare solutions are not just a public good, they are an economic imperative.

Headline Metrics for 2030 and 2035

To track its ascent, the UK Government has defined four core strategic outcomes:

| Strategic Metric | 2030 Target (Europe) | 2035 Target (Global) |

| Commercial R&D Investment | Highest in Europe | Highest globally (excl. US & China) |

| Access to Scale-Up Capital | Most raised in Europe | Most raised globally (excl. US & China) |

| Speed of Patient Access | Top-three in Europe | N/A (focus remains on European peers) |

| Life Sciences FDI Inflows | Largest in Europe | Largest globally (excl. US & China) |

Annual public reporting and scorecard updates will measure progress and provide accountability.

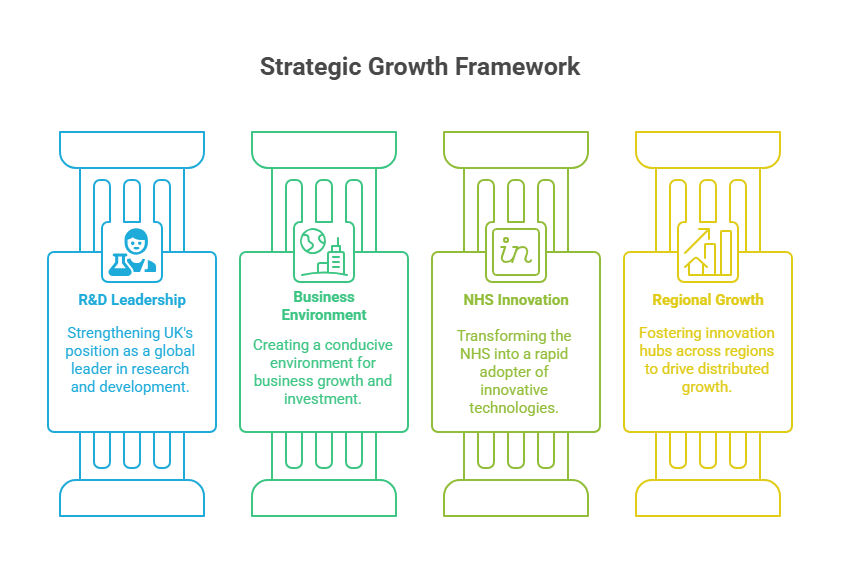

Key Levers to Reach the Top

1. Strengthening UK R&D Leadership

The plan backs over £2 billion in public sector R&D for this spending cycle, with long-term commitments in place. This investment is paired with efforts to position the UK as the best place in the world to run clinical trials.

- Health Data Research Service (HDRS): Up to £600 million to build a world-class, AI-ready data platform, making the UK globally competitive for real-world evidence generation and digital health trials.

- Clinical Trials Reform: Commercial trial setup timelines will be reduced to under 150 days by March 2026, with the goal of doubling trial participants by 2029, reversing recent declines in global trial rankings.

2. Creating a Business Environment for Scale

To overcome the UK’s historic late-stage investment gap, the government is launching significant capital initiatives:

- £4 billion in Growth Capital via the British Business Bank to crowd-in £12 billion in private funding for scale-ups.

- Life Sciences Innovative Manufacturing Fund (£520 million) to attract globally mobile manufacturing and bolster domestic resilience.

- Skills and talent are also a core focus, with new AI fellowships, a UK Research Workforce Strategy, and a Global Talent Taskforce designed to keep top-tier talent within the UK ecosystem.

3. Accelerating Innovation Through the NHS

The NHS is being transformed into a rapid adopter of innovation through:

- Joint MHRA-NICE approvals, reducing delays between regulatory sign-off and patient access.

- The Innovator Passport and Rules-Based Pathway (RBP) to fast-track adoption of proven MedTech and digital tools.

- A Single National Formulary to eliminate postcode prescribing disparities and ensure faster nationwide rollout.

- Confidential commercial pricing models to smooth reimbursement and enable equitable patient access across England.

4. Driving Regional and Cluster-Led Growth

Recognizing the need for distributed growth, the Plan invests in high-potential innovation hubs:

- Regional Health Innovation Zones will act as full-scale testbeds for integrated regulatory, commissioning, and digital transformation initiatives before national rollout.

- Strategic infrastructure, such as East-West Rail, HS2 nodes, and new city-region investment zones, will enable innovation clusters that rival global counterparts like Boston’s Kendall Square or Silicon Valley’s biotech corridor.

Governance, Risk, and Accountability

The plan isn’t just ambitious—it’s rigorously managed. Each of the 33 headline initiatives is assigned a Senior Responsible Officer and is linked to a clear performance metric. An annual implementation report and six-monthly Council reviews ensure mid-course corrections and transparency.

This governance model turns a visionary document into a living strategy—monitored, measured, and adjusted as needed.

Looking Ahead: A New Global Force in Life Sciences

If the outlined milestones are met, the UK will not only dominate Europe’s life sciences sector by 2030, but stand as the world’s third-most powerful life sciences economy by 2035, behind only the US and China.

This is more than a race to the top—it’s a national blueprint to build a virtuous circle of health innovation, economic growth, and global influence. With unmatched investment in R&D, capital access, streamlined NHS innovation pathways, and thriving regional clusters, the UK is positioning itself as the next global engine of biomedical progress.

For patients, this means earlier access to advanced treatments. For innovators, it offers a faster, more supportive commercialisation environment. And for the economy, it promises sustainable, inclusive, high-value growth in one of the most critical industries of the future.

As the Plan’s implementation begins, all eyes will be on whether the UK can translate ambition into impact—and reshape the global life sciences landscape in the process.