The Growing Demand for Medical Imaging Services: Top Key Trends Shaping the Future┬Ā

The global healthcare landscape is experiencing an unprecedented surge in the demand for medical imaging services, fundamentally reshaping how diagnostic medicine operates across all healthcare settings. This remarkable growth trajectory, with the global medical imaging market expanding from $41.9 billion in 2024 to a projected $68.4 billion by 2032, represents far more than simple statistical progressionŌĆöit reflects profound changes in demographics, technology capabilities, and healthcare delivery models that will define the future of diagnostic medicine. The confluence of an aging global population, rapid technological innovation, and evolving patient expectations has created a perfect storm of factors driving this extraordinary expansion in imaging utilization across all medical specialties.┬Ā

Healthcare systems worldwide are grappling with the implications of this exponential growth, as imaging services evolve from specialized diagnostic tools to fundamental components of routine medical care. The transformation extends beyond traditional hospital-based radiology departments to encompass point-of-care testing, mobile imaging units, and sophisticated telemedicine platforms that bring advanced diagnostic capabilities directly to patients regardless of their geographic location. This paradigm shift demands comprehensive understanding of the key trends that will shape the future of medical imaging services over the next decade.┬Ā

Demographic Forces Driving Unprecedented Growth┬Ā

The Silver Tsunami and Its Healthcare Implications┬Ā

The most significant driver of increased demand for medical imaging services lies in the fundamental demographic transformation occurring across developed and developing nations alike. The global population aged 65 and above is projected to double from 1.1 billion in 2023 to 1.6 billion by 2050, creating what demographic experts term the “silver tsunami” effect on healthcare systems. This demographic shift carries profound implications for medical imaging utilization, as older adults consume healthcare services at rates far exceeding younger populations.┬Ā

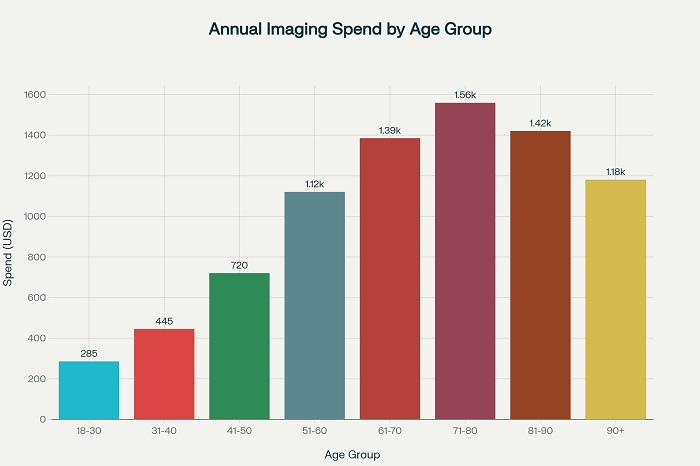

Research analyzing utilization patterns across the late life course reveals that annual imaging spending follows a distinctive inverted U-pattern, increasing steadily with age and peaking in the 71-80 age group at approximately $1,559 per person annually before declining in the later years. This peak coincides with the highest incidence of chronic diseases including cancer, cardiovascular conditions, and neurological disorders that require frequent imaging for diagnosis, staging, and treatment monitoring. The economic implications are staggeringŌĆödemographic changes alone could drive healthcare imaging spending increases of 18-22% over the next decade, independent of technological advances or expanded clinical applications.┬Ā

Annual medical imaging spending by age group showing peak utilization in the 71-80 age demographic┬Ā

The burden of chronic disease management amplifies this demographic impact significantly. Cancer incidence alone is projected to increase by 22% in Australia between 2021 and 2031, with an estimated 1.7 million new cases diagnosed during this period. Similar patterns emerge globally, with cardiovascular disease affecting approximately 500 million people worldwide and diabetes impacting more than 470 million individuals. Each of these conditions requires extensive imaging support throughout the patient journey, from initial screening and diagnosis through treatment monitoring and long-term surveillance.┬Ā

Gender-Specific Utilization Patterns and Clinical Implications┬Ā

Analysis of imaging utilization patterns reveals significant gender-based differences that influence overall service demand projections. Among individuals aged 14-70 years, women consistently demonstrate higher imaging utilization rates, primarily driven by reproductive health needs, breast cancer screening, and higher healthcare utilization patterns overall. However, men show higher utilization rates for certain advanced imaging modalities, particularly CT and MRI examinations related to cardiovascular disease and trauma-related conditions.┬Ā

These gender-specific patterns have important implications for capacity planning and resource allocation within healthcare systems. Women’s higher utilization of mammography, pelvic ultrasound, and bone density testing creates predictable demand patterns that can be incorporated into strategic planning models. Conversely, men’s higher utilization of emergency and trauma-related imaging creates more variable demand patterns that require flexible capacity management approaches.┬Ā

Technological Innovation as a Transformation Catalyst┬Ā

Artificial Intelligence Revolution in Medical Imaging┬Ā

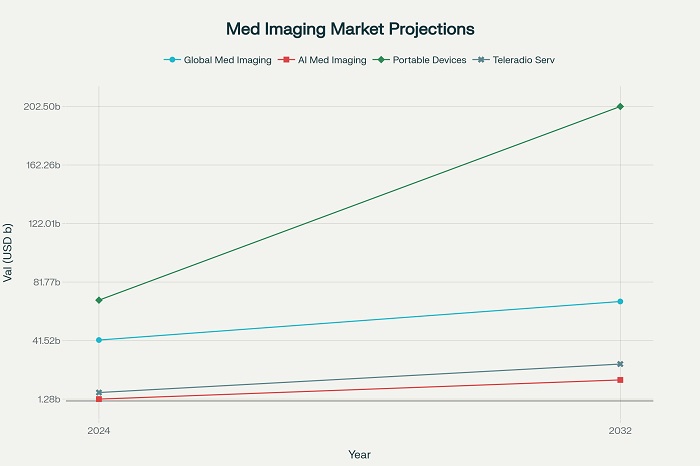

The integration of artificial intelligence into medical imaging represents perhaps the most transformative technological development in diagnostic medicine since the invention of computed tomography. The AI in medical imaging market is experiencing explosive growth, expanding from $1.28 billion in 2024 to a projected $14.46 billion by 2032, representing a remarkable 27.1% compound annual growth rate. This extraordinary expansion reflects the technology’s proven ability to enhance diagnostic accuracy, reduce interpretation time, and improve workflow efficiency across all imaging modalities.┬Ā

┬ĀMarket growth projections for key medical imaging segments from 2024 to 2032, showing explosive growth in AI and portable technologies┬Ā

┬ĀMarket growth projections for key medical imaging segments from 2024 to 2032, showing explosive growth in AI and portable technologies┬Ā

Deep learning algorithms now achieve diagnostic accuracy rates exceeding 95% for specific pathologies, with some applications demonstrating performance superior to experienced radiologists. Google’s DeepMind platform can analyze 3D retinal OCT scans and diagnose 50 different ophthalmic conditions with 99% accuracy, while also ranking patients by urgency and recommending appropriate treatments. Similarly, AI-powered stroke detection algorithms demonstrate 98.7% sensitivity in identifying intracranial hemorrhages from CT scans, significantly reducing time-to-diagnosis in critical emergency situations.┬Ā

The clinical impact extends beyond simple diagnostic accuracy improvements. AI-enabled systems reduce radiologist workload by automating routine tasks, prioritizing urgent cases, and generating preliminary reports that streamline workflow processes. Studies indicate that AI integration can reduce critical result reporting times by 37% while improving overall departmental efficiency by 35-50%. This efficiency enhancement becomes particularly crucial as healthcare systems face growing imaging volumes coupled with persistent radiologist shortages.┬Ā

Portable and Point-of-Care Imaging Revolution┬Ā

The demand for portable and point-of-care imaging devices is experiencing unprecedented growth, with the portable X-ray devices market expanding from $7.7 billion in 2024 to a projected $18.6 billion by 2034. This remarkable 9.4% compound annual growth rate reflects fundamental changes in healthcare delivery models that prioritize accessibility, convenience, and immediate diagnostic capability over traditional centralized imaging approaches.┬Ā

Portable imaging technologies enable healthcare providers to bring sophisticated diagnostic capabilities directly to patients, eliminating transportation barriers and reducing time-to-diagnosis in critical clinical scenarios. Emergency departments, intensive care units, and rural healthcare facilities particularly benefit from these capabilities, as portable systems enable immediate imaging without the delays and risks associated with patient transport to centralized radiology departments.┬Ā

The technological advancement of portable systems now rivals traditional stationary equipment in many applications. Modern portable ultrasound devices provide image quality approaching that of high-end console systems while offering wireless connectivity, cloud storage integration, and AI-powered automated analysis capabilities. These advances make portable imaging increasingly viable for routine diagnostic applications rather than limiting use to emergency or specialized scenarios.┬Ā

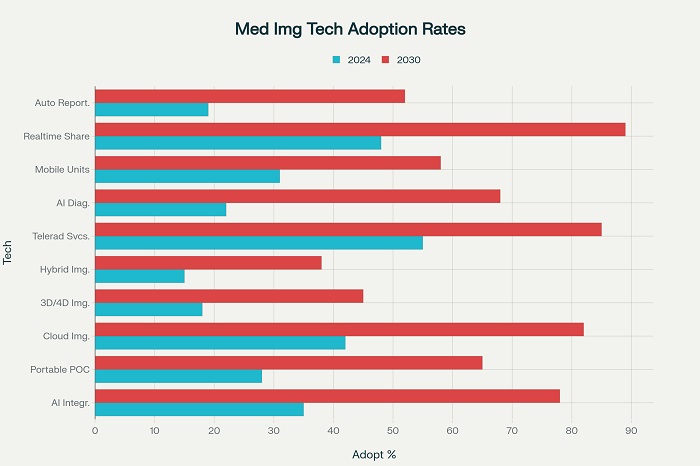

Current and projected adoption rates of key medical imaging technologies showing significant growth expected by 2030┬Ā

Current and projected adoption rates of key medical imaging technologies showing significant growth expected by 2030┬Ā

Cloud Computing and Digital Infrastructure Transformation┬Ā

Cloud-based imaging solutions represent another major technological trend reshaping medical imaging services delivery. Current adoption rates of 42% are projected to reach 82% by 2030, driven by the need for remote access capabilities, collaborative diagnostic platforms, and cost-effective storage solutions.┬Ā

Technology Trends Medical Imaging┬Ā

| Technology Trend┬Ā | Adoption Rate 2024 (%)┬Ā | Projected Adoption 2030 (%)┬Ā | Impact on Efficiency┬Ā | Primary Applications┬Ā | Investment Level┬Ā |

| Artificial Intelligence Integration┬Ā | 35┬Ā | 78┬Ā | High – 35-50% improvement┬Ā | Cancer detection, stroke diagnosis┬Ā | Very High┬Ā |

| Portable/Point-of-Care Imaging┬Ā | 28┬Ā | 65┬Ā | High – 40-60% faster diagnosis┬Ā | Emergency care, rural healthcare┬Ā | High┬Ā |

| Cloud-Based Imaging┬Ā | 42┬Ā | 82┬Ā | Medium – 25-35% workflow improvement┬Ā | Image storage, multi-site access┬Ā | Medium┬Ā |

| 3D and 4D Imaging┬Ā | 18┬Ā | 45┬Ā | High – 30-45% surgical planning┬Ā | Surgical planning, complex cases┬Ā | High┬Ā |

| Hybrid Imaging Modalities┬Ā | 15┬Ā | 38┬Ā | High – 15-25% diagnostic accuracy┬Ā | Oncology, cardiology, neurology┬Ā | Very High┬Ā |

| Teleradiology Services┬Ā | 55┬Ā | 85┬Ā | Very High – 24/7 coverage┬Ā | After-hours coverage, rural access┬Ā | Medium┬Ā |

| AI-Powered Diagnostics┬Ā | 22┬Ā | 68┬Ā | Very High – 95%+ accuracy rates┬Ā | Pathology, radiology, cardiology┬Ā | Very High┬Ā |

| Mobile Imaging Units┬Ā | 31┬Ā | 58┬Ā | High – 50-70% accessibility increase┬Ā | Rural outreach, disaster response┬Ā | Medium┬Ā |

| Real-time Image Sharing┬Ā | 48┬Ā | 89┬Ā | Medium – 20-30% communication speed┬Ā | Multi-disciplinary consultations┬Ā | Low┬Ā |

| Automated Reporting┬Ā | 19┬Ā | 52┬Ā | High – 60-80% report generation speed┬Ā | Standard reporting, quality metrics┬Ā | Medium┬Ā |

┬ĀCloud infrastructure enables healthcare organizations to store, analyze, and share vast amounts of imaging data without the substantial capital investments required for on-premise infrastructure.┬Ā

The benefits extend beyond simple cost savings to encompass improved workflow efficiency and enhanced collaboration capabilities. Cloud platforms enable radiologists to access imaging studies from any location, facilitating 24/7 coverage models and subspecialty consultation arrangements that improve diagnostic quality while optimizing resource utilization. Real-time image sharing capabilities, currently adopted by 48% of organizations, are projected to reach 89% adoption by 2030, enabling seamless collaboration between referring physicians, radiologists, and subspecialty consultants.┬Ā

Healthcare Delivery Model Evolution┬Ā

Teleradiology and Remote Services Expansion┬Ā

The teleradiology services market exemplifies the broader transformation of healthcare delivery models, with market values projected to expand from $5.8 billion in 2024 to $25.4 billion by 2032. This 10.1% compound annual growth rate reflects the technology’s proven ability to address radiologist shortages, provide 24/7 coverage, and extend subspecialty expertise to underserved geographic regions.┬Ā

Teleradiology adoption has accelerated dramatically, with current utilization rates of 55% projected to reach 85% by 2030. This growth is driven by multiple converging factors including persistent radiologist shortages, increasing after-hours imaging volumes, and the need for subspecialty interpretations in complex cases. Rural and community hospitals particularly benefit from teleradiology services, gaining access to radiologist expertise that would otherwise be unavailable or prohibitively expensive.┬Ā

The technology evolution within teleradiology continues to enhance service capabilities and clinical impact. Advanced features including AI-powered preliminary screening, automated critical result notification systems, and integrated reporting platforms improve both efficiency and quality of remote diagnostic services. Mobile teleradiology applications enable radiologists to review and report cases from smartphones and tablets, providing unprecedented flexibility in service delivery models.┬Ā

Decentralization and Outpatient Migration┬Ā

Healthcare delivery models are experiencing fundamental shifts toward decentralized, outpatient-focused approaches that influence imaging services demand patterns significantly. Independent Diagnostic Testing Facilities are experiencing rapid growth as patients and providers increasingly favor these facilities for their cost-effectiveness, accessibility, and specialized focus on imaging services. This trend reflects broader healthcare consumerization patterns where patients seek convenient, efficient, and cost-effective diagnostic options.┬Ā

The migration toward outpatient imaging settings is supported by technological advances that enable sophisticated diagnostic capabilities outside traditional hospital environments. Advanced CT scanners, MRI systems, and hybrid imaging platforms are increasingly deployed in outpatient settings, providing hospital-equivalent diagnostic capabilities with improved patient convenience and reduced costs.┬Ā

Outpatient imaging facilities also demonstrate greater flexibility in adopting new technologies and innovative service delivery models. These facilities often lead in implementing AI-powered diagnostic tools, patient engagement technologies, and efficiency optimization systems that enhance the overall patient experience while improving diagnostic quality.┬Ā

Specialized Applications Driving Market Expansion┬Ā

Oncology and Precision Medicine Integration┬Ā

The growing emphasis on precision medicine and personalized cancer care is creating unprecedented demand for advanced imaging services. PET imaging services are experiencing the highest growth rates among all modalities, with a projected 23% compound annual growth rate driven primarily by expanding oncology applications and precision medicine initiatives. Advanced imaging modalities including PET/CT, PET/MRI, and molecular imaging provide essential information for treatment selection, response monitoring, and long-term surveillance in cancer patients.┬Ā

The integration of imaging with genomic medicine and targeted therapy approaches requires more frequent and sophisticated imaging studies throughout the cancer care continuum. Theranostic applications, which combine diagnostic imaging with targeted therapy delivery, represent emerging frontiers that will further expand imaging utilization in oncology settings. These approaches require multiple imaging studies to select appropriate patients, monitor treatment delivery, and assess therapeutic response.┬Ā

Cardiovascular and Neurological Applications┬Ā

Cardiovascular imaging represents another major growth area, driven by the increasing prevalence of cardiovascular disease and the expansion of preventive screening programs. Advanced cardiac imaging modalities including cardiac MRI, CT angiography, and nuclear cardiology techniques provide detailed assessment of cardiac structure and function that guide both medical and interventional treatment decisions.┬Ā

Neurological imaging applications are expanding rapidly as well, particularly in response to the growing prevalence of neurodegenerative diseases including Alzheimer’s disease, Parkinson’s disease, and other conditions associated with aging populations. Advanced neuroimaging techniques provide essential information for early diagnosis, treatment selection, and disease monitoring in these complex conditions.┬Ā

Regional Variations and Global Market Dynamics┬Ā

The demand for medical imaging services exhibits significant regional variations that reflect differences in healthcare infrastructure, economic development, and demographic patterns. North America currently dominates global market share at 36.4%, supported by advanced healthcare infrastructure, favorable reimbursement policies, and high technology adoption rates.┬Ā

Regional Medical Imaging Analysis┬Ā

| Region┬Ā | Market Share 2024 in %┬Ā | Growth Rate CAGR in %┬Ā | Key Growth Drivers┬Ā | Leading Imaging Modalities┬Ā |

| North America┬Ā | 36.4┬Ā | 5.8┬Ā | Advanced healthcare infrastructure┬Ā | MRI, PET/CT, Advanced CT┬Ā |

| Europe┬Ā | 28.7┬Ā | 6.2┬Ā | Aging population, healthcare investment┬Ā | MRI, CT, Ultrasound┬Ā |

| Asia-Pacific┬Ā | 24.8┬Ā | 8.9┬Ā | Economic growth, healthcare expansion┬Ā | CT, X-ray, Ultrasound┬Ā |

| Latin America┬Ā | 5.9┬Ā | 7.4┬Ā | Healthcare modernization┬Ā | X-ray, Ultrasound, CT┬Ā |

| Middle East & Africa┬Ā | 4.2┬Ā | 9.1┬Ā | Infrastructure development┬Ā | X-ray, Ultrasound, Basic CT┬Ā |

| United States┬Ā | 28.1┬Ā | 5.5┬Ā | Technology adoption, reimbursement┬Ā | PET/CT, MRI, Advanced imaging┬Ā |

| China┬Ā | 8.9┬Ā | 9.8┬Ā | Healthcare digitization, AI adoption┬Ā | CT, AI-powered imaging, Digital X-ray┬Ā |

| India┬Ā | 4.3┬Ā | 12.5┬Ā | Rural healthcare access, cost-effectiveness┬Ā | Ultrasound, Digital X-ray, CT┬Ā |

| Japan┬Ā | 3.8┬Ā | 4.9┬Ā | Super-aging society, technology┬Ā | MRI, CT, PET imaging┬Ā |

| Germany┬Ā | 5.2┬Ā | 5.7┬Ā | Healthcare digitization, precision medicine┬Ā | MRI, CT, Nuclear imaging┬Ā |

┬Ā

However, the Asia-Pacific region demonstrates the highest growth rates at 8.9% compound annual growth rate, driven by economic development, healthcare system expansion, and increasing healthcare accessibility.┬Ā

India exemplifies the high-growth potential in emerging markets, with the diagnostic imaging market projected to grow at 12-15% annually and reach $7 billion by 2033. This growth is driven by expanding healthcare access, increasing awareness of preventive care, and government initiatives to improve healthcare infrastructure in rural and underserved areas.┬Ā

China represents another major growth market, with healthcare digitization initiatives and AI adoption driving rapid expansion in advanced imaging applications. The integration of AI technologies into clinical practice is occurring at unprecedented rates, with major hospitals implementing AI-powered diagnostic systems that enhance both accuracy and efficiency of imaging interpretations.┬Ā

Future Implications and Strategic Considerations┬Ā

The explosive growth in demand for medical imaging services creates both opportunities and challenges for healthcare systems worldwide. Capacity planning becomes increasingly complex as traditional volume projection models prove inadequate for capturing the impact of demographic shifts, technological innovations, and delivery model transformations. Healthcare organizations must develop sophisticated demand forecasting capabilities that incorporate multiple growth drivers and their interactive effects.┬Ā

Workforce development represents another critical consideration, as the growth in imaging demand substantially exceeds the growth in radiologist and technologist supply. The integration of AI and automation technologies provides partial solutions by enhancing productivity and enabling more efficient utilization of human expertise. However, comprehensive workforce strategies must address both quantity and quality considerations to ensure that increased imaging utilization translates into improved patient outcomes.┬Ā

Investment prioritization becomes increasingly challenging as healthcare organizations must balance competing demands for capital resources across multiple high-growth technology areas. Strategic planning frameworks must incorporate comprehensive assessments of technology impacts, patient outcomes, and economic returns to guide optimal resource allocation decisions.┬Ā

The transformation of medical imaging from a specialized diagnostic service to a fundamental component of routine healthcare delivery represents one of the most significant developments in modern medicine. Understanding and responding appropriately to the key trends driving this growth will determine the success of healthcare organizations in meeting the evolving needs of their patient populations while maintaining operational sustainability and clinical excellence.┬Ā