ÔÇťUnsustainableÔÇŁ is the word which best describes the healthcare system today. Frost & Sullivan is uncertain as to how far the healthcare industry will accede, but ÔÇťrising costsÔÇŁ, ÔÇťchanging demographicsÔÇŁ and ÔÇťqualityÔÇŁ are the three interlocking challenges nobody can disregard. Aging populations, limited clinical capacity, inefficiency and lack of quality remain the major drivers for an increase in healthcare spending through 2015.

ÔÇťUnsustainableÔÇŁ is the word which best describes the healthcare system today. Frost & Sullivan is uncertain as to how far the healthcare industry will accede, but ÔÇťrising costsÔÇŁ, ÔÇťchanging demographicsÔÇŁ and ÔÇťqualityÔÇŁ are the three interlocking challenges nobody can disregard. Aging populations, limited clinical capacity, inefficiency and lack of quality remain the major drivers for an increase in healthcare spending through 2015.

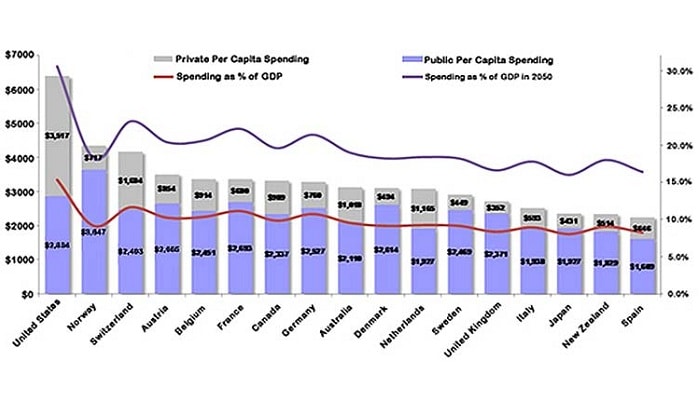

Chart 1.1 clearly indicates that in almost all countries worldwide, per capita healthcare spending is rising faster than per capita income. If current trends hold, by 2050 healthcare spending is expected to double, claming 20-30% of GDP for some economies and 20% by 2015.

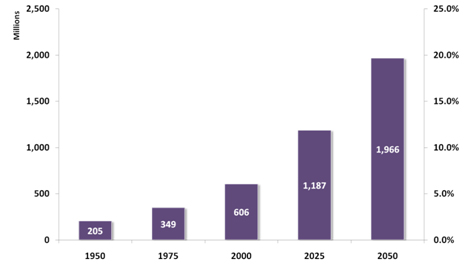

Chart 2 shows the increase in aging population over the years. In 2000, 10% of the global population was aged 60+. By 2015, this will be more than 21%. People aged 60+ utilize 3-5 times more healthcare services than younger people. Research shows that almost all people aged 60+ have one chronic condition, while 50% have two or more chronic conditions. Chronic diseases account for more than 60% of all health spending.

Given the costs of managing elderly and chronically ill patients, the patient monitoring market has a lot of potential to grow. An increase in the aging population will result in an increased demand for healthcare services in general, including monitoring devices. Telehealth and remote patient monitoring segments are the buzz words today due to an increasing number of aging baby boomers that require intensive home care. The patient Monitoring sector has developed itself from providing in-patient intensive care units to extensive applications in hospital, ambulatory and home healthcare.

The expanding incidence and diagnosis of diabetes will promote greater precautionary testing and data acquisition from patient monitors into paperless charting systems (EMRs). This will be the biggest driver for spending in the patient monitoring market. Not to forget, increasing awareness of patient monitoring systems among medical professionals is also a significant factor driving the patient monitoring systems market sales in Europe. Burgeoning partnerships between IT solution vendors and patient monitoring device manufacturers can be witnessed which is greatly driving convergence and integration. Consequently, integration of these products has become a booming industry presenting high profitability and plenty of growth opportunities.

Due to an increase in the cost cutting measures by the governments to cut down on the number of hospitals, Frost & Sullivan anticipates that the industryÔÇÖs attempts to move from just monitoring to patient management will be the future driver for the patient monitoring space.

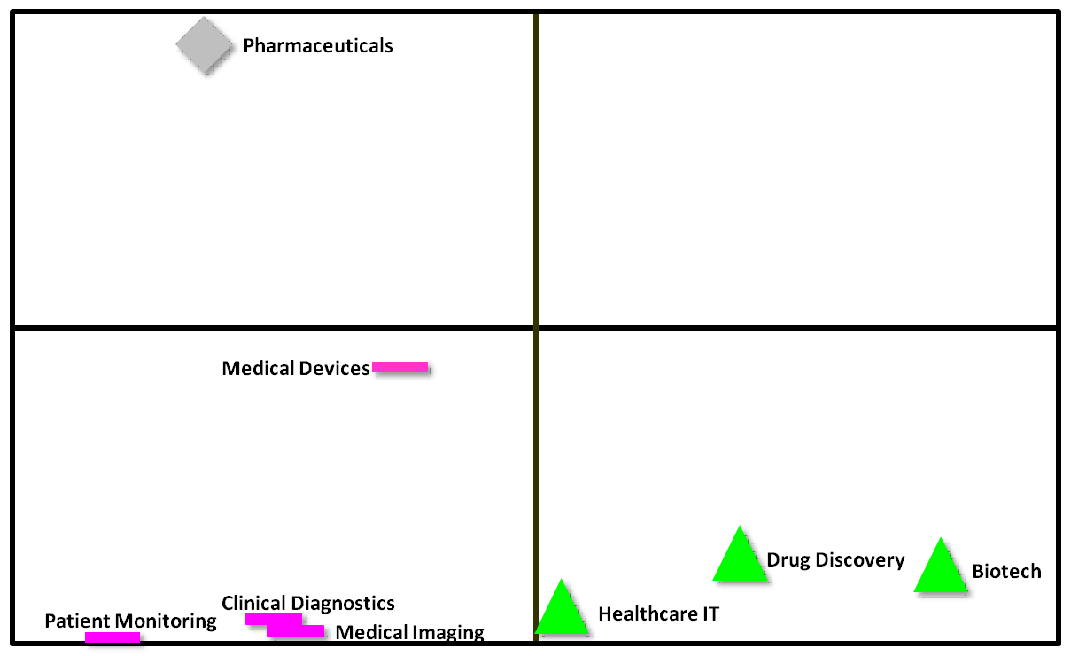

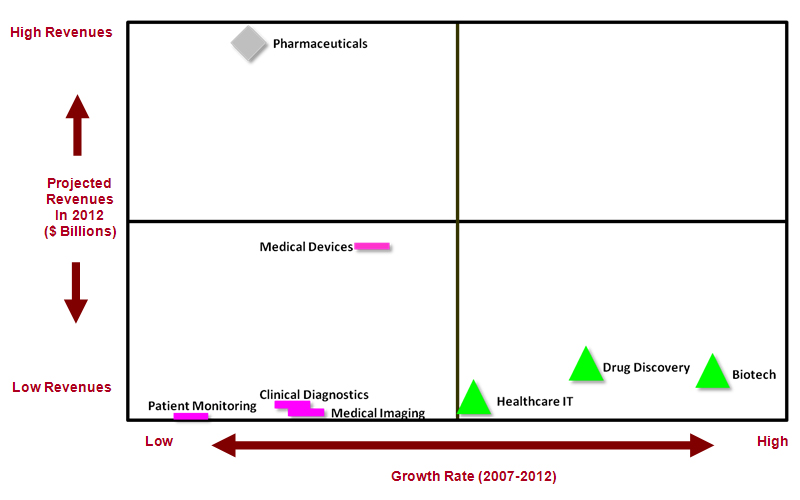

Chart 3 provides an opportunity analysis of spending across major areas of healthcare. Healthcare IT, Biotech and Drug Discovery will play a cardinal role in boosting healthcare spending in the near future. The healthcare market is expected to witness integration of pharma, diagnostics, medical devices, patient monitoring and healthcare IT. This will result in a high profile, risk free, user friendly, low cost and safe healthcare solution.

The Medical Device Industry is predicted to exhibit strong growth due to an expected increase in the cardiovascular products, orthopaedics and devices that enable less invasive medical procedures. The growing collaboration between the fields of information technology, pharmaceuticals and medical devices is also a growing trend. The inclination is towards developing minimally invasive products that allow patients to take care for themselves in a market eager for ways to save time, effort and money.

The shortage of nurses and doctors presents medical device companies with the opportunity to tap into robust markets in order to respond to the unmet needs produced by labour shortages. Medical Device companies will maintain accelerated market introduction by meeting product development and manufacturing needs. Wordwide market penetration and advances in technology will be the major drivers for an increased spending in the medical device industry. Consolidation in the market will promote accelerated time to growth, greater returns on invested capital and transformational innovation while maintaining high quality and patient efficacy. The rapid growth is also fuelled by EU accession. Harmonization of medical device legislation with the EU will make the Eastern European region attractive to multinationals.

Chart 4 shows the snapshot of opportunities across various areas in the medical technologies space. The medical imaging markets in Asia and rest of the world are expected to grow, while the major markets will be mature. The introduction of high quality healthcare in the developing countries has resulted in an overall increase in world-wide examinations. The driving factors for the medical imaging market remain the aging population and an effort to develop new cost effective systems to meet the need to control spiralling healthcare costs.

MRI is the highest revenue generating modality in medical imaging. The use of interventional MRI in brain surgery, cardiac MRI and MRI diffusion imaging used to diagnose strokes and other injuries to the brain would be the key factors for the medical imaging growth. Physicians practicing ÔÇťdefensive medicineÔÇŁ, technological advances, doctors and investors realising the huge potential medical imaging arena possess are the driving factors of the medical imaging industry. Frost & Sullivan believes that the marriage of imaging with therapy will be the major contributor to increased healthcare spending.

For the growing number of cancer survivors who have finished treatment, imaging also plays a recurring role. They undergo regular imaging assessments designed to detect or rule out recurrence or new disease for the duration of their lives.

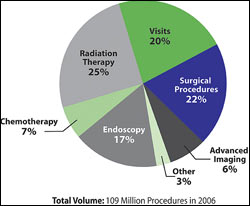

Chart 5 shows the forecast of outpatient cancer services distribution over the years 2007-2015 and the split of various imaging procedures that will spike up the healthcare spending in the medical imaging space. However, careful planning is essential for managing the significant growth in demand that looms for imaging services in cancer, especially for the advanced modalities, in the next decade.

|

|

|

|

|