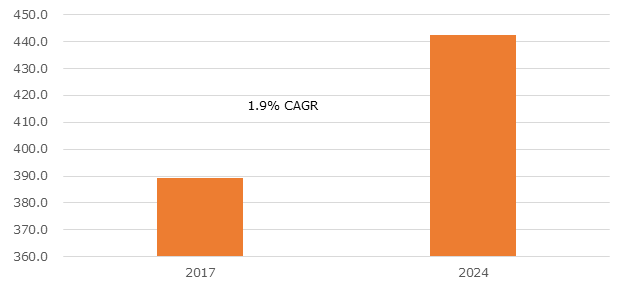

According to the Graphical Research new growth forecast report titled “Europe Immunohematology Market By Product (Analyzers, Reagents), By Technology (Biochips, Gel Cards, Microplates, PCR, Erythrocyte-magnetized Technology), By End-use (Hospitals, Diagnostic Laboratories, Blood Banks) Industry Analysis Report, Regional Outlook (Germany, UK, France, Spain, Italy, Russia, Poland, Czech Republic, Hungary, Switzerland, Denmark, Ireland, Netherlands, Bulgaria, Sweden, Austria), End-use Potential, Competitive Market Share & Forecast, 2018 – 2024”, exceed to exceed USD 442 million by 2024.

Rising prevalence of hematology disorders in European countries will foster industry growth. A stupendous rise in prevalence of hematological disorders including sickle-cell, leukemia and thalassemia is a major contributing factor driving demand for immunohematology analyzers. Thalassemia is an inherited blood disorder that results in an inadequate amount of hemoglobin production. The disorder results in destruction of large number of red blood cells causing anemia. Such patients need recurrent blood transfusions that proves beneficial for the industry growth.

Technological advancements in immunohematology analyzers is projected to drive the industry growth throughout the analysis period. Increasing focus of industry players on developing advanced immunohematology technologies will elevate the demand for immunohematology devices. For instance, several companies have launched a fully automated and high-throughput system for immunohematology. Advanced immunohematology systems can be used in

grouping, antibody screening, phenotyping, donor antibody screening, identification and cross-matching. Availability of such technologically advanced products will stimulate the industry growth. However, stringent regulatory scenario for immunohematology devices may hamper the business growth to some extent. Reagents segment held more than 65% revenue share in 2017 and will witness lucrative CAGR by 2024. This significant growth can be attributed to increasing number of haematological disorders that will surge the need for recurring blood testing. Additionally, diagnostic centres prefer reagents that provide results with high specificity. Above mentioned factors will escalate the segmental growth.

Reagents segment held more than 65% revenue share in 2017 and will witness lucrative CAGR by 2024. This significant growth can be attributed to increasing number of haematological disorders that will surge the need for recurring blood testing. Additionally, diagnostic centres prefer reagents that provide results with high specificity. Above mentioned factors will escalate the segmental growth.

Microplates segment was valued around USD 60 million in 2017 and is projected to show similar growth during the forecast period. Significant segmental growth can be attributed to advancements in microplates. Technologically upgraded microplates provide several advantages including cost-effectiveness, reusability, easy and rapid washings for antiglobulin tests. Furthermore, microplate testing is reliable with relatively small amount of reagents as compared to tube testing and thus, its adoption will increase in the coming years.

Blood banks segment accounted for substantial revenue in 2017 and will experience 1.7% growth over the analysis timeframe. Blood banks are gaining traction and have the potential to escalate sales of immunohematology devices as number of blood transfusions is increasing annually. Growing awareness regarding blood donation and increase in the number of voluntary donors will render significant impact on the business growth.

Few major industry players include Abbott, ANTISEL S.A., Beckman Coulter, Becton Dickinson, Bio-Rad Laboratories, Diagast, Grifols, Hologic, Immucor, Roche Diagnostics, Siemens Healthcare and Thermo Fisher Scientific. These key industry players adopt several strategic initiatives to enhance their revenue share. Approvals for new products will also prove beneficial for the industry growth. For instance, In October 2016, Immucor announced that its U.S. FDA approval for PreciseType HEA test to screen Sickle Cell Trait. The test provides clinicians and blood banks with the complete genetic matching information they need to reduce the risk of alloimmunization. The move will help to expand company’s existing product line.